Revenue Operations (RevOps)

What is RevOps, why you need it, and best practices. This guide provides definitions and practical advice to help you understand and establish world class revenue operations.

Revenue Operations Guide

What is Revenue Operations?

Revenue operations (RevOps) is a management model that accelerates revenue and profit by aligning the finance, marketing, sales, and customer success teams behind shared targets and objectives. The RevOps team is responsible for the software, data, systems, and processes that improve visibility between teams and efficiency across the full customer journey.

Benefits

The ultimate benefit of adopting RevOps in your organization is revenue and profit growth. Here are the key benefits which ladder up to that primary benefit:

- Aligning customer-facing teams across the entire customer journey behind shared targets and objectives. This gets everyone focused on the same specific KPIs, such as net new customers or growth of a new product.

- Breaking down data silos by integrating insights from Finance, Sales, Marketing, and Customer Success to understand new patterns in customer behavior, improve forecasting, and uncover new drivers for success.

- Improving each step of the customer journey such as optimizing campaigns by matching leads to outcomes, or tracking the effectiveness of quote and negotiation activities.

- Managing multiple sources of income such as recurring revenue models and self-service purchasing to the ever-expanding opportunity of ecommerce. Today’s B2B companies need to understand and manage earnings across a broader landscape than ever before.

How Revenue Operations Works

The RevOps framework has three main components: People, Processes, and Data.

PEOPLE: The exact configuration of your revenue operations team will depend on the size and needs of your business. Still, you should consider including the following roles:

- VP/Director of Revenue Operations who reports to the CRO or CFO.

The managers and analyst below report to the revenue operations leader:

- Marketing Ops Manager

- Sales Ops Manager

- Customer Success Ops Manager

- Systems Operations Manager

- Data Analyst

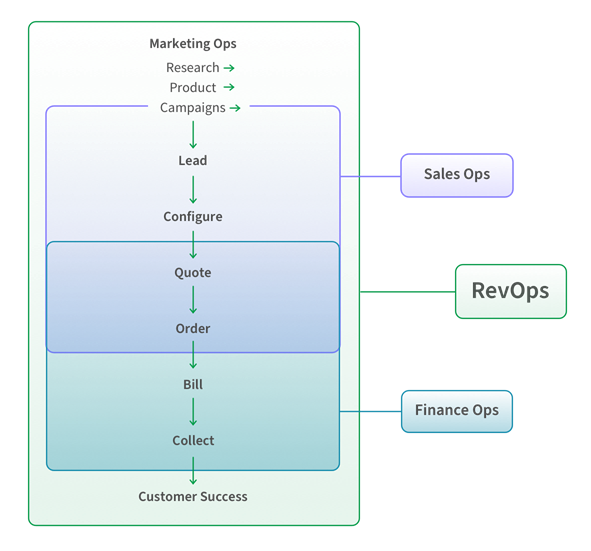

PROCESSES: The diagram below shows how revenue ops processes encompass all stages of the customer journey–from research and product development to customer service and success.

The revenue ops team will lead regularly scheduled planning, forecasting, and tracking meetings and define KPIs and metrics for all teams to monitor such as:

- Pipeline Velocity: how long it takes for leads to advance through each stage of your pipeline

- Win Rate: the percentage of opportunities that convert into customers

- Cost Per Acquisition (CPA): the cost to acquire a new customer

- Total Contract Value: the total worth of a contract

- Renewal Rate: the percentage of customers who renew with you

- Customer Churn: the percentage of customers who stop doing business with you in a given time period

- Customer Lifetime Value (CLV): the total worth a customer over the full period of their relationship with your company.

There are many more KPIs you can choose–for example: sales cycle time, annual recurring revenue, upsell rate, days sales outstanding, and revenue backlog. The most effective KPIs follow the SMART formula (Specific, Measurable, Attainable, Realistic and Time-Bound).

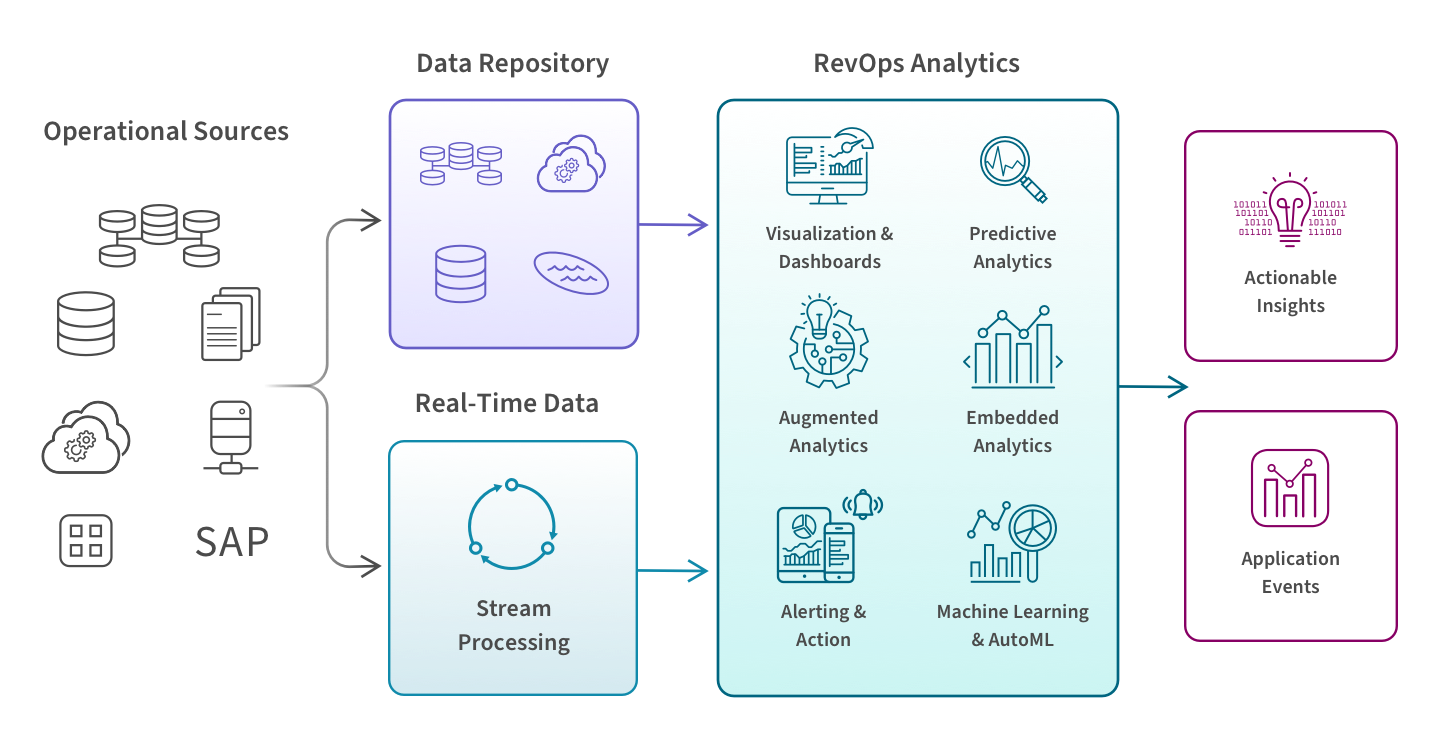

DATA: Modern revenue operations is powered by a cloud-based, end-to-end data integration and analytics platform. This platform helps you consolidate and manage big data across its lifecycle as well as perform the necessary types of analytics. The diagram below shows at a high level the full data and analytics system.

1. Identify all data sources. Your RevOps team will need data that likely sits in disparate systems – CRMs, ERPs and EPMs, data warehouses, and customer service applications. Find all data elements related to revenue and the customer journey. For example, you’d want data for marketing campaigns, products, leads, accounts, quotes, orders, contracts, payments, and renewals.

2. Consolidate data in a repository. Extract, transform, and combine all of these different types of data into a repository–typically a cloud data warehouse. This will give you a comprehensive view of your customer journey. Be sure to use a CDC tool to capture and track changes in our data over time.

3. Build a stream processor. If your organization produces a steady flow of real-time data, a streaming data process will allow you to respond to situations faster. Using a tool such as Apache Kafka or Amazon Kinesis, your data will be processed sequentially and incrementally on a record-by-record basis. This will allow your data to be immediately passed to downstream applications for analysis, presentation, or triggered actions.

4. Implement a RevOps Analytics Platform. This platform allows you to perform many types of analysis on your stored and/or real-time data–such as the following examples:

- Create real-time dashboards and interactive visualizations which help you identify patterns and develop insights faster

- Use predictive insights to spot revenue risks before they progress

- Combine your CRM data with other sources to improve your decision making

- Identify customer preferences and purchasing patterns to create better aligned sales strategies

- Use real-time sales data to improve your forecasting and revenue pipeline

- Maximize sales opportunities by using alerts and automation to drive timely actions.

Challenges

Building a successful revenue operations function isn’t as simple as asking key functions to work more collaboratively with each other. It requires a fundamental strategic realignment, underpinned by a sophisticated and cohesive approach to data. Here are three key challenges to be aware of as you implement modern revenue operations in your organization.

1. Bringing All Your Data Together. Revenue operations demands a cross functional view, but the data you need may sit in disparate systems and siloes like CRMs, ERPs and EPMs, data warehouses, and customer service applications. You should make sure to find a RevOps analytics tool which includes the data integration capabilities you’ll need.

2. Sharing Data Where it Matters. For revenue ops to be truly effective, data-driven insights need to be shared wherever work gets done. Your team members need to be able to access and collaborate on data, no matter where they are or what they’re doing. This is difficult – if not impossible – within legacy and siloed data infrastructures. Collaborative, interactive workflows are crucial to a successful revenue ops function. Whether by allowing your team to communicate through notes and observations, enabling them to access key information on mobile devices, or providing up-to-the minute notifications about changes or setting triggered alerts for specified thresholds, a new approach to revenue demands a new approach to data as well.

3. Turning Insights Into Actions. You need to be able to convert raw data into purposeful actions. But limitations within your existing data platforms can act as a barrier. Your team can spend more time cleaning and managing data than they do analyzing and understanding it. Legacy interfaces can demand an almost arcane understanding of data terms, and with no machine learning or AI to lean on, you can be forced to do most of the predictive analysis yourself.