Finance Analytics

For businesses to thrive, finance, accounting and reporting departments must deliver accurate and actionable insights in real time. Qlik synthesizes disparate financial and accounting data into powerful finance analytics that help you reduce costs and manage risks, improve profitability and transparency, and guide more informed decisions.

Explore Finance Analytics

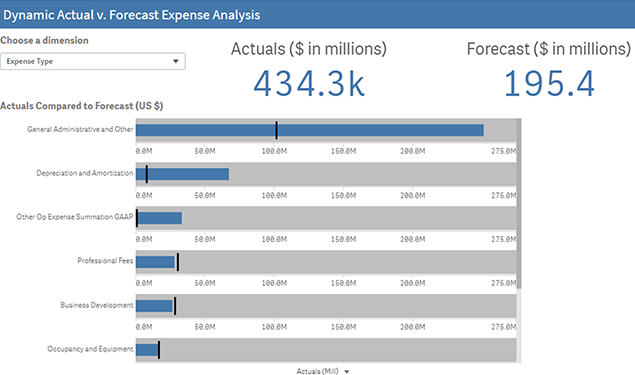

Expense management with finance analytics

-

Drive cost reduction and improve expense management

Find new ways to save money and improve financial processes by using financial analytics to analyze large volumes of data from multiple geographies and business lines. -

Quickly analyze large volumes of vendor contract data to make smarter spending decisions

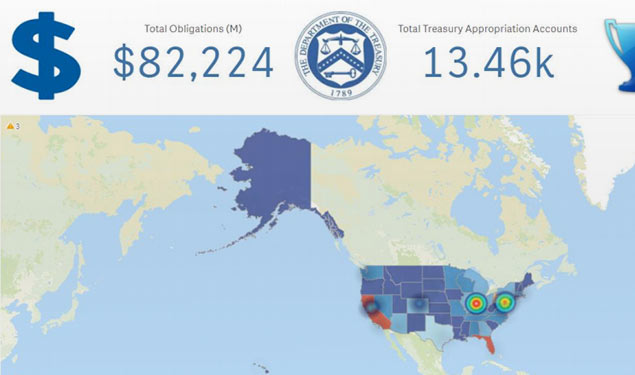

In this demo, see how six years of data from over two million US government vendor contracts can be efficiently analyzed to uncover important trends and develop more cost-effective vendor strategies. -

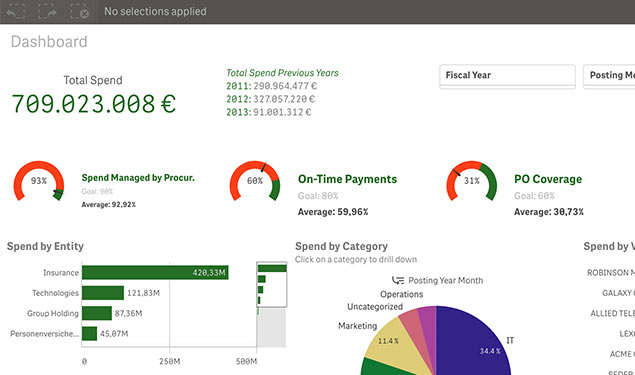

Optimize the procurement process

Explore this demo to understand how Qlik’s finance analytics empowers finance departments with the ability to monitor spending, payments and balances—along with contract status and dates—to more effectively manage the procurement process.

Explore top finance analytics resources

Improving Business Performance through Modern Finance Analytics: 10 Stories of Success

Explore financial data without boundaries

Qlik's powerful Associative Engine lets you combine multiple, complex sources of data that can be explored in any direction. Analyze financial performance, develop forecasts and run highly flexible financial simulations. Imagine viewing last quarter's largest cost variances, then pivoting to identify the factors that drove them. Or, suppose you could see the relative IRR of your top five product lines over the past two years, and instantly shift your view based on geography, distribution model, or any other factors to gain deeper insight. With Qlik, you can always learn more by simply asking "Why?".

Financial analysis and planning to optimize budget allocations and forecasting

-

Enable true data-driven forecasting, budgeting and planning

Qlik streamlines processes while providing more in-depth analysis of forecasting, budgets and financial plans. Create more effective strategies to save money and manage risk.

Qlik vs spreadsheets – focus on analyzing data, not preparing it

Many finance teams rely on spreadsheets like Excel to analyze data. As convenient as this seems, it introduces many challenges. With spreadsheets, people spend about 80% of their time manually extracting and prepping data and only 20% analyzing it. And layering on additional visualization tools just adds another step to this process. Further, this ungoverned process can often introduce inaccurate data, which reduces confidence in your financial analysis.

Qlik automates and accelerates data integration and prep, empowering finance teams to focus their time exploring trusted, governed data using powerful analytics to uncover hidden insights they can’t find with spreadsheets.

Finance analytics for revenue and profitability management

-

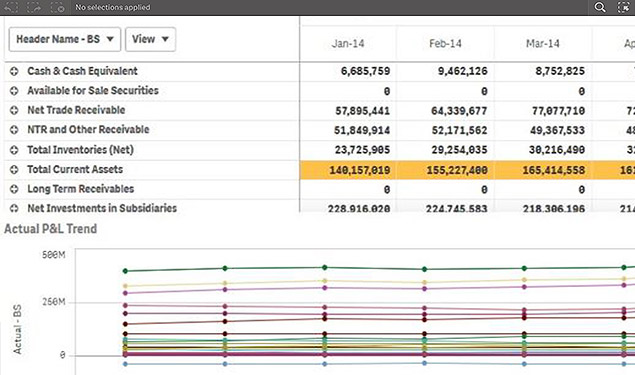

Streamline financial reporting and reduce financial burden

Learn more about how Qlik makes cash-flow and balance sheet management far less labor- and time-intensive. Qlik also creates easy access to insights that enable finance teams to accelerate reporting and reduce financial burden. -

Improve financial performance with a complete view of products and services

Gain a complete, multi-dimensional view of your product portfolio to more effectively identify and act on evolving marketing behaviors and pricing tradeoffs. Drive growth and increase margins through reduced slippage. Mitigate risks from underperforming revenue streams.

Modern finance analytics for risk and compliance

-

Enhance operational and financial control in governmental finance

Governmental organizations have unique finance and accounting challenges. Qlik’s dynamic finance analytics can improve financial management, support efficient regulatory compliance, and maximize program performance and spend.